The business cycle is a fundamental concept in economics that describes the fluctuations in economic activity over time. It reflects the rise and fall of economic growth and is characterized by periods of expansion and contraction. Understanding the nature of cause and effect within the context of the business cycle is crucial for businesses, policymakers, and economists alike. This article explores how various factors interplay to create economic cycles, examining the intricacies of cause and effect in this context.

What is the Business Cycle?

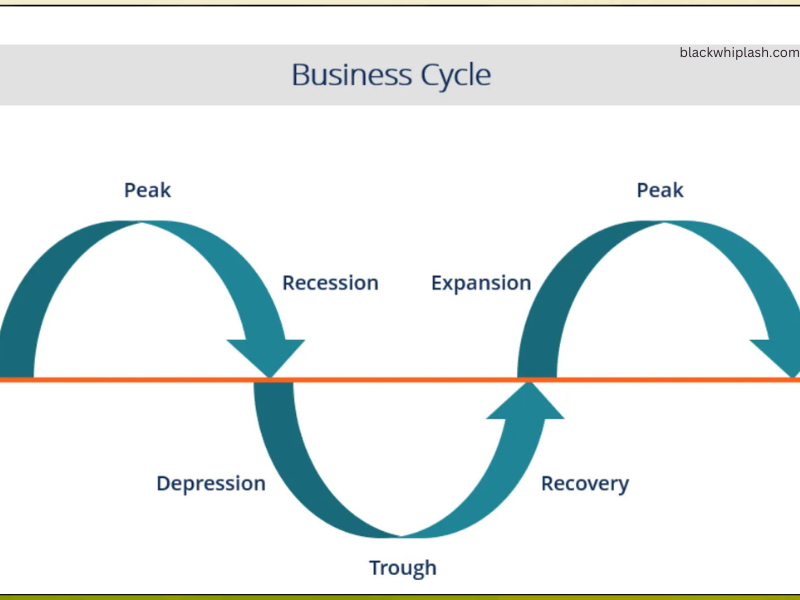

The business cycle consists of four primary phases: expansion, peak, contraction, and trough. During expansion, economic activity increases, leading to higher employment rates and rising production. The peak marks the highest point of economic activity before a downturn begins. Contraction, often referred to as a recession, is characterized by decreasing economic activity, leading to layoffs and reduced spending. Finally, the trough is the lowest point of the cycle, after which the economy begins to recover and expand once again.

Understanding these phases is essential for analyzing the cause-and-effect relationships that drive economic changes. Each phase influences and is influenced by various economic indicators, including consumer spending, business investment, government policies, and external factors such as global economic conditions.

The Interplay of Cause and Effect

Economic Indicators as Causes and Effects

Economic indicators play a crucial role in the business cycle. They serve as both causes and effects, creating a feedback loop that influences the overall economic climate. Key indicators include:

Gross Domestic Product (GDP): A rising GDP signifies economic expansion, while a declining GDP indicates contraction. Changes in GDP can be caused by increased consumer spending or investment, which in turn affects employment rates and income levels.

Unemployment Rates: High unemployment can lead to decreased consumer spending, resulting in lower GDP and economic contraction. Conversely, lower unemployment usually signifies economic growth, leading to increased spending and investment.

Inflation: Inflation rates can significantly impact purchasing power and consumer behavior. High inflation may lead to decreased spending as consumers anticipate rising prices, causing a slowdown in economic growth.

Consumer Behavior

The Driving Force

Consumer behavior is a significant factor in the business cycle, often acting as a cause and effect mechanism. When consumers are confident in their economic situation, they tend to spend more, driving economic expansion. Conversely, during times of uncertainty or fear, consumers tend to save more and spend less, contributing to economic contraction.

Example

The 2008 Financial Crisis

The 2008 financial crisis serves as a pertinent example of the cause-and-effect relationship in the business cycle. Leading up to the crisis, consumer confidence was high, leading to increased spending on housing and consumer goods. However, the housing bubble burst, causing a loss of confidence and a drastic reduction in spending. This shift triggered a recession, demonstrating how consumer behavior can pivotally affect the business cycle.

Business Investment

A Dual Role

Business investment is another crucial element in the cause-and-effect relationship of the business cycle. Companies invest in capital goods, research, and development to expand their operations, which typically drives economic growth. However, during economic downturns, businesses often cut back on investments, exacerbating the contraction phase.

Cause

Increased business investment often leads to job creation, increased production capacity, and economic expansion. For instance, when businesses invest in technology, it can lead to higher productivity and efficiency.

Effect

Conversely, reduced business investment can lead to layoffs and lower economic output, perpetuating a cycle of contraction. For example, during a recession, businesses may delay or cancel projects, leading to reduced economic activity and further declines in employment.

Government Policies

Shaping Economic Conditions

Government policies significantly influence the business cycle through fiscal and monetary measures. These policies can be seen as both causes and effects within the economic context.

Fiscal Policy

Government spending and taxation decisions can stimulate or dampen economic activity. For instance, increased government spending during a recession can spur growth by creating jobs and increasing demand. On the other hand, austerity measures can lead to reduced spending and economic contraction.

Monetary Policy

Central banks, such as the Federal Reserve in the United States, utilize monetary policy to influence the economy. Lowering interest rates encourages borrowing and spending, promoting economic expansion. Conversely, raising interest rates can curb inflation but may also slow economic growth.

Example

The COVID-19 Pandemic

The COVID-19 pandemic exemplifies how government policies can shape the business cycle. Governments worldwide implemented stimulus packages to support businesses and consumers during the economic downturn. These policies aimed to mitigate the effects of the pandemic and promote recovery, demonstrating the role of government action as a cause of economic recovery.

Global Economic Conditions

Interconnectedness

In an increasingly globalized economy, international factors play a significant role in the business cycle. Events such as trade wars, global pandemics, and geopolitical tensions can have profound effects on domestic economic conditions.

Cause

For instance, a slowdown in a major economy can lead to reduced demand for exports, impacting domestic industries and employment rates.

Effect

Conversely, robust global economic growth can stimulate domestic economies through increased exports, leading to expansion.

Technological Advancements

A Catalyst for Change

Technological advancements have a profound impact on the business cycle, influencing both cause and effect relationships. Innovations can drive economic growth by improving productivity and creating new industries.

Cause

The introduction of new technologies often leads to increased efficiency and reduced production costs, enabling businesses to expand.

Effect

However, rapid technological change can also lead to disruptions in the labor market, as certain jobs become obsolete, contributing to economic fluctuations.

Psychological Factors

The Role of Confidence

Psychological factors, such as consumer and business confidence, play a critical role in the business cycle. The perception of economic conditions can influence decision-making, creating a cause-and-effect relationship that can either spur growth or lead to contraction.

Cause

High levels of confidence can drive increased spending and investment, contributing to economic expansion.

Effect

Conversely, low confidence can result in reduced spending and investment, exacerbating economic downturns.

Conclusion

The nature of cause and effect in the context of the business cycle is complex and multifaceted. Economic indicators, consumer behavior, business investment, government policies, global conditions, technological advancements, and psychological factors all intertwine to create a dynamic and ever-changing economic landscape. Understanding these relationships is crucial for businesses, policymakers, and economists as they navigate the challenges and opportunities presented by the business cycle.

By recognizing the intricate web of cause-and-effect dynamics, stakeholders can make informed decisions that promote sustainable economic growth and stability. As the business cycle continues to evolve, the importance of understanding these relationships will only increase, shaping the future of economies worldwide.

In a rapidly changing global environment, staying attuned to the nuances of the business cycle is essential for adapting to new challenges and seizing opportunities for growth and innovation.